Explore every episode of An Arm and a Leg

| Pub. Date | Title | Duration | |

|---|---|---|---|

| 14 Nov 2019 | Mom vs. Texas | 00:28:53 | |

Stephanie Wittels Wachs has a daughter born with hearing loss, which is how she found out insurance didn't cover hearing aids for kids. Those start at $6,000 and only last a few years. Stephanie teamed up with a few other moms to change Texas law... and won. Stephanie is a terrific storyteller. She's the author of Everything Is Horrible and Wonderful, a memoir about grieving her brother, Harris Wittels, a writer for TV comedies like Parks and Recreation, who died of a heroin overdose. ... and she is the host of the new podcast Last Day, which uses her brother's story as a starting point for a deep and smart and very-human look at the opioid crisis. Highly recommend: https://www.lemonadamedia.com/show/last-day P.S. This podcast, An Arm and a Leg, is a finalist for a very-strange, very-approriate award: Best True Crime show of 2019. Because not all crimes are against the law. Let 'em know: Go vote for us right now — voting closes November 18: https://awards.discoverpods.com/finalists/ Also: We'd love it if you support this show on Patreon: https://www.patreon.com/armandalegshow Thanks! Hosted on Acast. See acast.com/privacy for more information. | |||

| 13 May 2020 | From inside the health insurance company: Angst, and advice we can use. | 00:16:32 | |

A listener, who has worked in health insurance for decades, wrote in. "I have listened to all the episodes in this podcast, and there are times I come away feeling bad working for the insurance company." We talked. Along with angst, she shared insights and advice we all can use. Hosted on Acast. See acast.com/privacy for more information. | |||

| 28 Apr 2021 | Why picking the right insurance is so hard (bonus/encore) | 00:20:14 | |

How hard is it to pick the best health insurance? ECONOMISTS find it hard. Including one who has studied the question, "How hard can it be to pick a decent insurance plan?" Lots of people are suddenly eligible to pick possibly-cheaper health insurance thanks to the American Rescue Plan—the big stimulus bill Congress passed in March—so we thought it could be useful to bring this 2018 story back. Also useful: This essay from health-care reporter Zachary Tracer about how he picked his health insurance, with directions for you (that start with pouring yourself a drink) There are more how-tos, and health insurance basics, on our web page from the original version of this story. And here's a VERY useful tool, described in the episode—for if you live in DC, Massachusetts, New Mexico, Oregon, Rhode Island, or Vermont As always, we'd love you to share a story or support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 14 Feb 2020 | Reporter's Notebook: What we've learned so far, and what's ahead. | 00:33:45 | |

This bonus episode turns the tables: Ace reporter Sally Herships interviews Arm and a Leg host Dan Weissmann, about what he's learned so far, and what's ahead for the show. \They dig into the stories listeners are sharing -- the lessons people say they’re learning, and the lessons they’re sharing. And Dan previews the celebrations in store as the show hits a landmark: 500 Patreon supporters! If you haven't signed up already, there's still time to join us -- sign up by March 1 -- and earn some special rewards. https://www.patreon.com/armandalegshow Hosted on Acast. See acast.com/privacy for more information. | |||

| 19 May 2021 | Mini-episode: One guy skirts a medical-bill trap, and shares the secret. | 00:07:24 | |

When Adam Woodrum's insurance denied a claim for an ER bill, he sent his story to NPR... because he happened to KNOW how to deal with it. And he figured it would be a friendly thing to share what he knew. (Kudos, Adam!) This story was originally reported by Julie Appleby for our pals at Kaiser Health News, and KHN editor-in-chief Elisabeth Rosenthal weighs in at the end. Hosted on Acast. See acast.com/privacy for more information. | |||

| 07 Apr 2021 | Programming note: We're working on some cool new stuff. | 00:01:34 | |

... and it's gonna take us a little while to get it ready for you— maybe a couple months. Meanwhile, we'll have little updates for you here and there. ... and it's a great time to sign up for our newsletter, where we'll have details on what's next, and stories we think you'll be interested in. Here's where to go: https://armandalegshow.com/newsletter/ Hosted on Acast. See acast.com/privacy for more information. | |||

| 12 Dec 2019 | Can they freaking DO that?!? | 00:27:39 | |

A woman got a bill from a medical testing lab she’s never heard of, for $35. Then, a follow-up bill said if she didn’t pay up right away, that price was going up — WAY up: to $1,287. Which raises a question that comes up a LOT with medical billing: Can they freaking DO that?!? Can some random lab hit you up for money — and then threaten you with a late fee of more than $1,000?? On this episode, we go find out. This was fun. We'll do it again. Next time you want to know, Can They Freaking DO That?!? ... get in touch. Also: We get into a whole story in this episode about "surprise billing" — and as we were publishing this episode, news was breaking. We've got an update at https://www.patreon.com/armandalegshow Hosted on Acast. See acast.com/privacy for more information. | |||

| 27 May 2020 | The hug shortage, the new abnormal, and the $7,000 COVID test. What we've learned in SEASON-19 | 00:22:12 | |

We wrap up our COVID-19 popup season with stories from three folks with very different takes on what we've learned so far about what the pandemic is costing us: A doctor and advocate in Brooklyn looks back on the wave of black and brown patients that filled her clinic in March. A nurse-practitioner in Texas looks at how new tech is—and isn't—helping the older patients she cares for. And: One of the country's top insurance nerds says her first policy ideas to keep people from getting stuck with high bills for COVID tests ... were wrong. Get ready for the hug shortage, the new abnormal, and the $7,000 COVID test. And: Help guide the next steps for this show! Take five minutes for our listener survey. We so appreciate it. Thanks to everyone who supports the show on Patreon. You can join 'em here: https://www.patreon.com/armandalegshow Hosted on Acast. See acast.com/privacy for more information. | |||

| 26 Dec 2019 | Christmas in July | 00:26:17 | |

How one family's tragedy became, decades later, a $1 million gift to their neighbors. This story has everything: Laughter. Tears. Family. Community. Generosity. Softball. AND: Punk rock. John Oliver. A taco bar. Hosted on Acast. See acast.com/privacy for more information. | |||

| 16 Sep 2021 | "We just kept right on pushing" | 00:25:41 | |

Manny Lanza died because he didn't have insurance. His parents fought back, with help from New York’s favorite tabloid. After years of work by advocates and organizers, laws suddenly changed. Here’s how. Here's a transcript for this episode. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we'd love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 02 Jan 2020 | Watch Your Back: Outwitting the Back-Pain Industry | 00:28:59 | |

Cathryn Jakobson Ramin, an investigative reporter with a bad back, spent years researching the $100-billion back-pain industry. She found that the most commonly-prescribed treatments, including surgery, frequently do not work — and often leave people a lot worse off. She also learned what does work. Whenever someone I know says their back is killing them, I send them a link to Ramin's 2017 book, Crooked: Outwitting the Back Pain Industry. In this episode, we hit the highlights of Ramin's findings. Hosted on Acast. See acast.com/privacy for more information. | |||

| 18 Dec 2020 | From our reporter's notebook: What we learned in 2020, and what's ahead, with T.K. Dutes | 00:23:29 | |

This episode turns the tables: Host Dan Weissmann gets interviewed about what he's learned this year, and what's ahead for the show— with T.K. Dutes, an ace radio host and podcast-maker ... who was a nurse in a previous life, so she knows a thing or two about the health-care system. (She chronicled her career transition in an episode of NPR's Life Kit.) And here we learn: During her nursing career, she was uninsured. She's got some stories about life before-and-after health insurance. T.K. also coins what could be a new tagline for this show: "Where there's money, there's going to be scams." Check out Open World, a terrific podcast T.K. published recently with fellow superstar Rose Eveleth. The first episode features a reading by and discussion with the writer N.K. Jemisin, who won a MacArthur "genius" award the day after the show came out. (Clearly, the MacArthur folks were listening.) Support us: During November and December 2020, your donation counts for DOUBLE, thanks to a campaign called NewsMatch. So cool. You can make a one-time donation OR make an ongoing monthly pledge. Here’s the link: https://armandalegshow.com/support/ Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG Hosted on Acast. See acast.com/privacy for more information. | |||

| 04 Dec 2020 | Andy Slavitt gives us a COVID check-in from 40,000 feet | 00:27:40 | |

Andy Slavitt, who ran a big chunk of health care for the Obama administration, has spent 2020 talking with almost everybody who knows anything about the COVID pandemic— and sharing what he learns in real time, first on Twitter, then on his pandemic podcast "In the Bubble." When we wanted an episode taking a look at the big picture—what we've learned so far from the pandemic and what we might expect next—Andy was the person we wanted to talk to. And he said yes! We got into the money side of what we can expect with vaccines and testing, and treatment—which wasn’t always pretty but wasn't all bad news—and we ended up with some really big-picture questions about the profit motive in health care. Support us: During November and December 2020, your donation counts for DOUBLE, thanks to a campaign called NewsMatch. So cool. You can make a one-time donation OR make an ongoing monthly pledge. Here’s the link: https://armandalegshow.com/support/ Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG Hosted on Acast. See acast.com/privacy for more information. | |||

| 15 Jul 2021 | Badass volunteers help Jared level up, in the fight to crush medical debt | 00:10:48 | |

An update on Jared Walker, whose viral TikTok described a little-known (and effective) method to “crush” many hospital bills, and offered to help folks deploy it. Since then, he's been responding to thousands of requests for help—and building a system to respond more effectively, thanks to a small army of whip-smart volunteers. Jared’s non-profit, Dollar For, has got that system up and running. So: If anyone you know has a hospital bill they can’t pay, the system can quickly tell them if they might qualify for debt forgiveness, and get them started on an application. Here’s the link. Pass it around. Also, if you want to see that original 60-second video, it's here. Here’s the transcript for this episode. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we'd love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 03 Sep 2020 | She tangled with health insurance every day for 25 years. And loved it. Here's what she can teach us. | 00:25:30 | |

Barbara Faubion got up every day psyched to go to work—which she says puzzled her friends. “They’d go, ‘You love your job?!? You spend your whole day talking to an insurance company. Are you kidding me?’” She wasn’t kidding. Because she loved to win—and she was really, really good at untangling other people’s health-insurance problems. She's here to teach us what she knows. And we'll learn something else too, from a conversation with ProPublica reporter Marshall Allen: Why doesn't EVERY health insurance broker have someone like Barbara on staff? This story he did in 2019 has some big clues. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG Support us: https://www.patreon.com/armandalegshow (Audio excerpt from “Going Down Now” used with permission. ℗&© 2020 The Rockmores. Published by The Rockmores, Boston, MA www.therockmores.com. All rights reserved. Unauthorized use is a violation of applicable copyright laws.) Hosted on Acast. See acast.com/privacy for more information. | |||

| 27 Nov 2019 | Health Care: The Musical | 00:22:17 | |

It would sound a LOT like Explanation of Benefits, which is a musical revue that actually played in New York City in 2019. ... so it would feature a parody of "Bills, Bills, Bills" — the 1999 Destiny's Child hit —rewritten for the age of GoFundMe. And it would have smart, funny musical numbers tracing the long, sad history of the U.S. health care industry. Welcome to our musical episode! And thank you to the young NYC troupe Heck No Techno for creating Explanation of Benefits. Our episode isn't sung all the way through — it's more like the PBS documentary on Hamilton than an actual musical of its own. But that is still. Pretty. Darn. Cool. AND: In keeping with our theme this season of self-defense against the cost of health care, Explanation of Benefits wraps with a set of short vignettes demonstrating ways patients can work to protect themselves from excessive charges. So we have included here an email-by-email breakdown of songwriter Emily Lowinger's successful battle to fight off a surprise medical bill. ... and we've set it off with music — timing and cues lovingly adjusted by our audio wizard, Adam — and it is a TREAT. Go enjoy. Have a great Thanksgiving! ... and speaking of thanks: I recently spent a weekend afternoon sending thank-you cards to folks who support this show on Patreon. I'd love it if you became one: https://www.patreon.com/armandalegshow Hosted on Acast. See acast.com/privacy for more information. | |||

| 06 Apr 2020 | Makers unite: Speeding PPE to a COVID hospital | 00:20:55 | |

We kick off SEASON-19, about the cost of COVID, with a dose of hope — a story about an unlikely chain of people coming together to speed PPE to a COVID hospital in Brooklyn. NYC is a couple weeks ahead of the rest of the country, we think, so there are lessons here we can all get ready to use. Especially this: Don't be afraid that what you have to offer isn't enough. Take the step in front of you, even if it's a little one. Here's a couple ways to start

... or leave a message on our hotline: (724) 276-6534. That's (724) ARM N LEG. Hosted on Acast. See acast.com/privacy for more information. | |||

| 25 Feb 2021 | Revisiting insulin, as relevant (and expensive) as ever | 00:31:06 | |

We're re-releasing and updating a story we first reported in 2019, about how insulin got to be so horribly expensive—the scientists who discovered it did NOT want price or profits to keep it away from people who need it—and what some people are doing about it, today. The story seems especially relevant right now, for two reasons:

Also, the whole thing is a wild ride. And: The updates from people we talked to in 2019? All more encouraging than we'd expected. Here's a transcript for this episode. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we'd love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 17 Mar 2021 | Who's been trying to cash in on COVID vaccinations? (And how did racism help them out?) | 00:31:42 | |

With COVID vaccinations ramping up, it's time to check in: Who's been trying to make a buck? And who's been doing their best to serve the folks who need help the most? In Philadelphia, the good, the bad, and the ugly have all been on vivid display. The Bad comes with a giant serving of chutzpah: For a while, the city put its mass-vaccination program in the hands of a 22 year-old with no experience in health care, but with a healthy interest in making money. It did NOT go well. (You may have seen that headline before. We get the deep dive from public-radio reporter Nina Feldman, who uncovered the caper.) The Ugly is systemic racism: Or is it just a coincidence that the city put its trust in a white 22 year-old... while ignoring an effective group of licensed, experienced, Black health-care professionals who were volunteering their time? That would be the Black Doctors COVID-19 Consortium, led by Dr. Ala Stanford. The Good is the work that Dr. Stanford and the Consortium have been doing, which throws the Bad and the Ugly into stark relief. Since last spring, they've been working tirelessly and creatively to address disparities in the care that Black Philadelphians receive for COVID-19. They're not the only folks working to address those disparities—including a lack of good vaccine information from trusted sources. Here's a great example from a project called The Conversation: Between Us and About Us, hosted by comedian W. Kamau Bell: You can watch it here: https://www.youtube.com/watch?v=qp6S4C6zG_M We talked with one of the project's leaders, Dr. Rhea Boyd, author of a recent New York Times essay, Black People Need Better Vaccine Access, Not Better Vaccine Attitudes. (Disclosure: The project is backed by the Kaiser Family Foundation, who also are behind our co-producers at Kaiser Health News.) Here's a transcript for this episode. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we'd love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 29 Dec 2020 | A 21st-century Christmas Carol: How one Scrooge became a health-care whistleblower | 00:21:58 | |

Former health-care executive Wendell Potter spent part of 2020 publishing high-profile apologies for the lies he says he told the American people in his old job—and trying to debunk the myths he once sold. The story of how he became a whistle-blower is a modern-day Christmas Carol. And it's a story about the long, messy process of change—whether that’s changing your own life or trying to change a bigger system. It’s a great way to close out a pretty-terrible year. Another cheerful note: THANK YOU!!! Your support for this show has MAXED OUT the matching program NewsMatch. It’s a huge, huge boost for our work in 2021. Of course, we could still use your support before the year ends. We would love it. There is SO much work ahead. AND, if you’re looking for other places to help out, here are a few places doing powerful work:

And of course it is absolutely not too late to support this show. Here’s that link: https://armandalegshow.com/support/ Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG Hosted on Acast. See acast.com/privacy for more information. | |||

| 30 Sep 2021 | Wait, that was legal until now?!? | 00:26:54 | |

Hospitals in Maryland were suing patients over bills that should’ve been forgiven. It wasn’t illegal. Until now. How a coalition changed that. This year. Plus, our friends at Dollar For build their bill-crushing army, one Zoom training at a time. Need help applying for charity care for you or a loved one? We compiled a list of five helpful tips. Here's the transcript for this episode. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we'd love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 14 Oct 2021 | We spend 12 million hours a week on the phone with health insurance | 00:19:39 | |

Yup. A Stanford professor measured it. So… we should probably learn how they actually make money, understand their incentives. Here’s one clue: A lot of the time, providing insurance isn’t their real job. In this episode, we unpack what that means, and we start exploring how to put that knowledge to work. Here’s a transcript for this episode: https://armandalegshow.com/wp-content/uploads/2021/10/12-Million-Hours-An-Arm-and-a-Leg-Transcript-S6-Ep05-12.pdf Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we’d love for you to support this show: https://armandalegshow.com/support/ Hosted on Acast. See acast.com/privacy for more information. | |||

| 01 Nov 2021 | Meet the Insurance Warrior | 00:23:45 | |

In 2005, Laurie Todd needed surgery to save her life. Her insurance company had no intention of paying for it. She went to war, and won. She's been helping other do the same ever since. Now, she's sharing her secrets with us. Psst: This month, when you support this show, every dollar you donate is DOUBLED, thanks to NewsMatch and the Institute for Nonprofit News. Holy cow. Here's the link. Also:

Hosted on Acast. See acast.com/privacy for more information. | |||

| 11 Nov 2021 | The Insurance Warrior takes on a $61B Company | 00:24:19 | |

When Mattew Lientz needed surgery to save his life, his insurance wouldn’t cover it. Enter: Laurie Todd, the Insurance Warrior. Her first task: Figuring out who Matthew was really fighting, and how big the battle really was. Together, Matthew, his wife Diane, and Laurie made the case for Matthew’s life. Fourteen years later, the speeches they gave in a conference room full of insurance executives are a masterclass in winning insurance appeals — and living to tell the tale. The battle also illustrates a lesson that Laurie Todd learned while fighting it: Fighting your health insurance often means fighting... your employer. Yep, most employers “self-insure.” And in this case, that employer was one of the biggest companies in the world. Here’s a transcript of the episode. For the Insurance Warrior's origin story, check out our previous episode. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we’d love for you to support this show. This month, every dollar you donate is DOUBLED, thanks to NewsMatch and the Institute for Nonprofit News. Holy cow, what a deal. Here, go for it. Hosted on Acast. See acast.com/privacy for more information. | |||

| 24 Nov 2021 | How to avoid the crappiest health insurance. | 00:24:52 | |

We kick off with a wild ride: How one journalist almost got roped into a scam. While hunting for a new insurance plan, Mitra Kaboli got an offer that seemed too good to be true—but seemed to be coming from her current insurer. Mitra was skeptical, and it turns out, she had every reason to be. Dania Palanker from Georgetown University's Center on Health Insurance Reforms unpacks this sketchy scheme, and gives us the key to avoiding it: When you're searching for health insurance... skip Google. Seriously. Then, some top health insurance nerds teach us how to really shop for health insurance: where to find the fine print and how to read it. They also deliver some good news (for once): Thanks to subsidies in the American Rescue Plan some deals this year are actually… deals! Meaning: health insurance got more affordable for lots of people this year. Here's the subsidy calculator we mention in the episode. Want to read all of those tips in one place? Check out First Aid Kit, the newsletter where we're summing up all the practical stuff we've been learning since this show launched. Here’s a transcript of the episode. And of course we’d love for you to support this show. This month, every dollar you donate is DOUBLED, thanks to NewsMatch and the Institute for Nonprofit News. Holy cow, what a deal. Here, go for it. Hosted on Acast. See acast.com/privacy for more information. | |||

| 09 Dec 2021 | Fighting with health insurance is easy (for Jacqueline Fox) | 00:19:01 | |

Health insurance is like some medieval horror, says law professor Jackie Fox. But, funny thing: She also says insurance fights are easy. For her. She’s been helping people win them for 30 years. Jackie Fox has a lot to teach us. And class is in session. Here’s a transcript of the episode. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we’d love for you to support this show. This month, every dollar you donate is DOUBLED, thanks to NewsMatch and the Institute for Nonprofit News. Holy cow, what a deal. Here, go for it. Hosted on Acast. See acast.com/privacy for more information. | |||

| 20 Dec 2021 | Why rapid COVID tests are so freaking expensive | 00:20:45 | |

Who’s making a buck: rapid test edition. Rapid, at-home COVID tests are pretty much essential if you want to see friends and family this holiday season, and stay safe. But they’re freaking expensive and can be hard to find. What the heck happened? When ProPublica reporter Eric Umansky went looking for COVID tests recently, he came back empty handed. He and fellow reporter Lydia DePillis investigated, tracing the US’s rapid testing problem all the way back to the FDA and other government agencies. Plus, Dr. Celine Gounder talks about why these tests are so important in the first place and how best to deploy them this holiday season — if you can find some. Here’s a transcript of the episode. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we’d love for you to support this show. UPDATE: We've pushed past the amount the NewsMatch campaign has funds to match(!) ... and we can keep going with your help. And earn a bonus. If we raise $5,000 to match funds folks have already donated, the Knight Foundation will give us a $1,000 bonus. Please help us now! Gotta get it done by Dec. 31. Here, go for it. Hosted on Acast. See acast.com/privacy for more information. | |||

| 30 Dec 2021 | Our Year in Review, with members of the Arm and a Leg team | 00:15:02 | |

An Arm and a Leg wraps up a big year, and some of the team takes a moment to reflect. Consulting Managing Producer Daisy Rosario, Editor Marian Wang, and Associate Producer Emily Pisacreta join host Dan Weissmann in a conversation on why we make the show and what we look forward to doing in 2022. Hosted on Acast. See acast.com/privacy for more information. | |||

| 13 Jan 2022 | 2022 update: How to avoid a big bill for your COVID test (feat. Sarah Kliff) | 00:23:13 | |

COVID testing—the kind they send to a lab— is supposed to be free in the U.S. But it’s never been quite that simple. We’re revisiting our sadly-still-relevant interview with Sarah Kliff from the New York Times, who joined us in November 2020 to share what she learned from reading hundreds of COVID testing bills. Her advice? Avoid the ER, do some research ahead of time, and ask if they’re going to do any other tests (which may not be covered 100%). We summed up some of her advice in a recent First Aid Kit newsletter, and then added some more COVID-test advice in this week's First Aid Kit. Here's a transcript for this episode. Got a story to tell, or a wild bill to share? Get in touch. We can only make this show because listeners like you support us. Wanna pitch in? Hosted on Acast. See acast.com/privacy for more information. | |||

| 27 Jan 2022 | Meet your new rights under the No Surprises Act | 00:18:00 | |

The No Surprises Act — a new law that protects us from some outrageous out-of-network hospital bills — takes effect this month. That's great news, but (and there’s always a but) there are some important caveats to know about. Like, for instance: these protections only apply to care you get in a hospital. Then there’s the deceptively-named Surprise Billing Protection form they might ask you to sign. And there’s more. We break down what you need to know about your rights under this new law, what traps to look out for, and who to call if something smells fishy. Actually, here: The federal hotline for reporting No Surprises Act violations: 1-800-985-3059. Big thanks to our guides: Patricia Kelmar, Health Care Campaigns Director at U.S. PIRG, and Julia Nigrelli from health care consulting firm Chi-Matic. The federal hotline for reporting No Surprises Act violations: 1-800-985-3059. Here’s a transcript for the episode. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 10 Feb 2022 | Introducing: Last Day | 00:41:13 | |

Stephanie Wittels Wachs has made the show about a topic that's actually too enraging, terrifying, and depressing for An Arm and a Leg: the opioid crisis. And it's as entertaining, empowering and useful as we could ever want. It's called Last Day. Here's episode 1. (In case you need convincing that it's entertaining, we'll tell you: In this episode, she interviews comedians Sarah Silverman and Aziz Ansari at length.) Part of what makes Last Day so good is that Stephanie is a great storyteller — as well a truly tireless crusader, and a witty, real-as-they-come human being. We should know — we had her on An Arm and a Leg to talk about how she and a few other Texas moms got state laws changed to cover hearing aids for kids. (You can catch that episode here: https://armandalegshow.com/episode/mom-vs-texas/) If you haven't already met her there, you're going to love her here. It turns out that nearly everybody you know is either struggling with — or loves someone, or knows someone — who is struggling with some really difficult shit. ...and for some reason, we continue to keep these stories hidden away. Just eating at our insides. This is a show about that.

Last Day made a second season, about suicide and mental health, and its third season, about America's gun-violence epidemic, is coming this spring. You can listen to everything, and subscribe to get new episodes, here: https://lemonadamedia.com/show/lastday/ Hosted on Acast. See acast.com/privacy for more information. | |||

| 24 Feb 2022 | Introducing: Half Vaxxed | 00:24:54 | |

Last year we brought you the story — part caper, part tragedy — of how Philadelphia tried to hand off its COVID vaccination program to a wannabe tech bro right out of college. We built on the work of reporter Nina Feldman and her colleagues at WHYY. Now, they've laid out the entire thing in a podcast of their own, called Half Vaxxed. It’s terrific. Funny in places, horrifying in others, and full of lessons. We'll be back in a few weeks to start the next batch of Arm and a Leg episodes. Meanwhile, we hope you'll enjoy the first episode of Half Vaxxed. Meanwhile, don't miss our First Aid Kit newsletter, where we're sharing practical tips on surviving the world's most-expensive health care system. Catch all of Half Vaxxed here Hosted on Acast. See acast.com/privacy for more information. | |||

| 10 Mar 2022 | Swimming with sharks | 00:26:12 | |

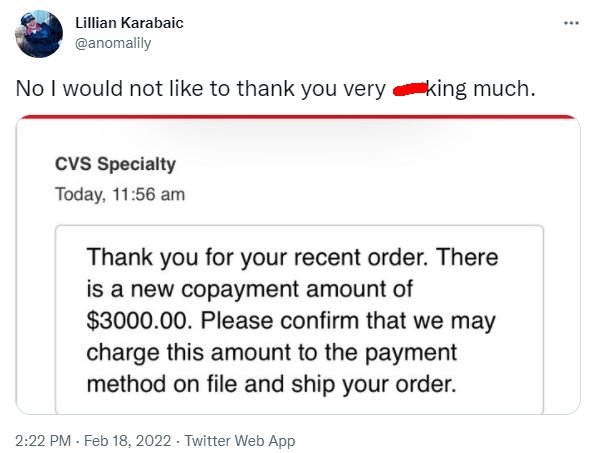

Pharma and insurance companies play devious, clever games, competing for dollars. They’re sharks! It’d be fun to track, but they’re eating us alive. If anyone could beat the sharks at this game, we’d pick Lillian Karabaic, who runs the personal finance show/community called Oh My Dollar! — and is SUPER on-top-of her stuff. But Lillian recently got socked with an unexpected $3,000 charge— and expects to lose her very-organized fight against it.

Understanding how Lillian got here — how pretty much any of us could, and how we can start to fight back, together — means understanding the games these big sharks are playing. Which is exactly what we do in our latest episode, with Lillian’s expert — and often very-funny — guidance. This episode goes deep on a shark game called a “copay accumulator” policy. In short, they’re an invention by the insurance industry to make sure only YOUR money counts toward your yearly deductible — not any assistance you may receive from a drug company. One thing we learned: Finding out if your insurance plan even includes one of these policies can be extremely tough: Otherwise, Lillian — who did her extremely-good best to check for this very information — wouldn’t have gotten taken by surprise. We’ve got a little bit of help to offer: Researchers from a nonprofit called The AIDS Institute also researched this question, looking at hundreds of plans across the country. And they developed a tip sheet a tip sheet to help guide their search: How to search online, what questions to ask if the information just isn’t online (which happens). More resources:

Here’s a transcript of the episode. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 24 Mar 2022 | Fighting for the Right to Help | 00:19:04 | |

It’s illegal to advise someone who’s being sued for medical debt, unless you're a lawyer. Yep, really. Even in its most basic form (like helping people fill out a checklist) it’s considered the “unlicensed practice of law.” And it’s a crime. As in, you could go to jail. So some New Yorkers are suing to get that changed. The non-profit Upsolve wants to help people represent themselves in court when they’re being sued over debt. Their plan is to train people like pastors, social workers, and librarians and others to help people others know their rights. And iIn the Bronx, Reverend John Udo-Okon is one of those volunteers, ready to help. We meet the CEO of Upsolve and Reverend John to talk about their work – and why they’re suing the state of New York. Here’s a transcript of the episode. Subscribe to our newsletter, First Aid Kit. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 07 Apr 2022 | Sick Note: Dan has COVID. (He's fine, but ...) | 00:02:28 | |

Hey there — I got COVID a little before we were scheduled to tape this week's episode. Whoops! I'm fine now, but kinda tired. Just to be on the safe side — some people stay tired for a while — let's give me two weeks before we come back with a full episode. Meanwhile, I'll share this: I think one reason I got better quick was, I was able to get anti-viral meds. (Paxlovid, in my case.) And I mention this because: There's a new variant going around, BA.2, which looks like it's going to bring on a new wave; we don't know how big it'll be yet, but the New York Times had some good tips recently for how to be prepared. One was: Have a plan for getting antiviral treatment, in case you do get sick. Some docs don't like to prescribe them, and some folks shouldn't take them because of things like drug interactions. It's worth knowing your best options ahead of time. I'm here to co-sign that advice. The rest was good too. Here's the link: https://www.nytimes.com/2022/03/30/well/live/ba2-omicron-covid.html Finally: Even this two-minute sick note has a highly-entertaining moment, thanks to a listener who wrote a surprising response to a recent First Aid Kit newsletter... then recorded that note as a voice memo. So, I'll catch you in a couple weeks. Till then: Take care of yourself, for real. And as always:

Hosted on Acast. See acast.com/privacy for more information. | |||

| 21 Apr 2022 | Sick Note, pt. 2: Dang | 00:00:59 | |

Dan’s COVID has hung on there for a while, kept him SUPER tired. Yoinks. Back in a couple weeks! Meanwhile, as always, we'd love for you to:

Hosted on Acast. See acast.com/privacy for more information. | |||

| 05 May 2022 | “The Golden Age of Older Rectums” (for investors) | 00:19:56 | |

A new golden age is dawning, and it starts where the sun don’t shine. A listener got a pricey quote for her colonoscopy, but the medical practice behind it seems like “the only game in town.” We scope it out and learn the surprising reason why: Investors have decided your butt is a goldmine. Private equity investors have made their way into many areas of our lives. Now, they’re at the gastroenterologist’s —and lots of other medical specialists, too. We learned why these doctors are selling their practices to private equity, and what it could mean for your health care and your bills. Correction notice: The original version of this story mis-identified the organization where Claire McAndrew worked when we spoke to her in 2019. Whoops. We've updated the audio file, so it's correct now. Here's a transcript for this episode. As always, we'd love you to:

Hosted on Acast. See acast.com/privacy for more information. | |||

| 26 May 2022 | Credit Where It’s Due | 00:17:37 | |

Credit reporting bureaus announced in April that they would start taking most medical debt off of people’s credit reports. At first, we weren’t sure that would be such a huge deal. After all, the medical debt would still exist, people would still get harassed by debt collectors, or even sued over it. But it turns out, there’s a bunch of reasons why these changes could be life-changing, and we want to give credit (the good kind) where it’s due. The changes include:

Plus, some an end to some games debt collectors can play with your credit score. Here’s a transcript of this episode. Subscribe to our newsletter, First Aid Kit. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 16 Jun 2022 | These docs are trying to kick private equity out of their ER | 00:21:42 | |

About a third of ER doctors now work for companies backed by private equity. A lot of those docs do not like the arrangement, which they say puts profits ahead of patients. Now, a group of ER docs are suing to kick one of those private-equity owned companies out of their hospital-- and all of California. They see it as the first step in a long, long fight. The suit cites California’s ban on the “corporate practice of medicine” — which is supposed to outlaw situations where non-doctors tell doctors what to do, for profit. Which raises a question: How did it get left to a group of doctors to get that law enforced? We break it down, with help from:

And while you're here, why not:

Hosted on Acast. See acast.com/privacy for more information. | |||

| 07 Jul 2022 | One ER Doc’s Journey Through the Pandemic — and the Health Care System | 00:21:14 | |

Thomas Fisher is an emergency room doc in Chicago. His book, The Emergency, is an up-close chronicle of the COVID pandemic’s first year in his South Side ER. It also zooms out to tell the story of his journey as a doctor: How his upbringing on the South Side fueled his desire to become a doctor. And how the realities and inequities of American health care limited his ability to help. He details how the failures of the American health care system — and the racial inequities it perpetuates — leave health care workers with a profound sense of moral injury. “Over time, when you have this conflict between what you can do and what you're supposed to do—what you wish you could do, what you're trained to do—that creates a moral conundrum….It also leads a lot of people to leave the profession ” For a time, Fisher himself stepped away from practicing medicine. The journey took him to the executive suite but ultimately landed him back in the ER where he started. On the street outside the hospital where Fisher works, he sits down with host Dan Weissmann to discuss the book and his search for meaning in the daily sprint of life in the ER.

Hosted on Acast. See acast.com/privacy for more information. | |||

| 28 Jul 2022 | The Genetic Testing ‘Bait-and-Switch’ | 00:18:02 | |

Is it possible for a health care company to make enough people mad about their billing practices that it hurts their business? For one genetic testing company, maybe so. An Arm and a Leg listener Jessica got a test that’s become routine in early pregnancy: non-invasive prenatal testing. It was supposed to be $99. But then — after she took the test — that turned into $250. And when she asked questions, she was told it could go up to $800 if she didn’t pay up quick. , Jessica looked up the testing company, and found out that lots of people experienced what she called “the genetic testing bait-and-switch.” And she’s not the only one who noticed. When some guys on Wall Street, plus New York Times reporter Sarah Kliff, started hearing about those bills, the company found itself in some hot water. Here’s a transcript of the episode. Bonus reading:

Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 18 Aug 2022 | The Medical-bill "Negotiation Lab" | 00:23:58 | |

It’s often possible to negotiate medical bills. It sounds hard — and it can be — but what if we got it down to a science? Mapped out all the moves ahead of time? Jared Walker and his team at the nonprofit Dollar For are running a big experiment to see if they can do just that. And we got to visit the lab. The folks at Dollar For caught our attention — and lots of other people’s—when they went super-viral on TikTok with a 60-second recipe for crushing medical debt by accessing charity care, financial assistance that most US hospitals are legally required to offer. That was early 2021. Next, a group of whip-smart volunteers helped Dollar For develop a user-friendly system to help folks apply for that assistance. Dollar For also started holding open trainings on Zoom, teaching people the ins and outs of applying for charity care—and helping others to do so. They say their work to date has helped erase more than $18 million in medical debt. But lots of people who can’t afford their medical bills don’t qualify for charity care. So Dollar For is trying something new: what they’re calling a “negotiation lab” for gaming out the best way to negotiate with hospitals and debt collectors. We listen-in on one of Dollar For’s real-life negotiations with a debt collector and take notes.

Hosted on Acast. See acast.com/privacy for more information. | |||

| 08 Sep 2022 | Congress fixed (a piece of) Medicare. It only took a few decades. | 00:26:01 | |

Lots of seniors have to pay thousands of dollars for drugs—even tens of thousands—or do without life-saving medicine. That’s finally going to change. The new Inflation Reduction Act will set a $2,000 cap on out-of-pocket drug costs for seniors. (Yes, it’ll do a bunch of other stuff too.) It took a long time. Folks like researcher Stacie Dusetzina spent years building evidence about how Medicare prescription drug policy was failing people with cancer and other conditions. The pharmaceutical industry fought this change tooth and nail — for decades. Julie Rovner, Chief National Correspondent for Kaiser Health News, takes us on a journey back to the late 1980’s, when Congress learned the cost of messing with Big Pharma.

Hosted on Acast. See acast.com/privacy for more information. | |||

| 29 Sep 2022 | California plans to make its own insulin and sell it super-cheap. Really. | 00:19:26 | |

This year, the state of California put up $100 million to produce its own insulin, and sell it for cheap. How’s it going to work? (Is it going to work?) The price of insulin could be the starkest example of our out-of-control health care system: More than 7 million Americans need it to survive, and some die because they can’t afford it— medicine that’s been around for 100 years, medicine its discoverers didn’t want to patent. We look at how California’s plan came to be, and what might stand in the state’s way. Further listening:

Also, we mention our recent coverage of the legal and lobbying power of the pharmaceutical industry. That’s in our last episode, here: https://armandalegshow.com/episode/congress-fixed-a-piece-of-medicare/ Here’s a transcript of this episode.

Hosted on Acast. See acast.com/privacy for more information. | |||

| 20 Oct 2022 | Quick update from Arm and a Leg HQ | 00:05:10 | |

Hey there, You may have noticed, we've been keeping a slower pace for the last few months — publishing every three weeks instead of every two — since Dan recovered from COVID. And every-three-weeks is gonna stay our default for now. Putting out the show more often was wrecking Dan's health, and some important behind-the-scenes work just wasn't getting done. When we slowed down the podcast release schedule, we also suspended the First Aid Kit newsletter, which compiles our most-useful information for dealing with the out-of-control medical system. Starting today, First Aid Kit is back — publishing monthly instead of every-other-week. (We're telling you, Dan was pushing too hard before.) If you're already a subscriber, you should have a new issue in your inbox right now. If you're not a subscriber yet, why not sign up? Hosted on Acast. See acast.com/privacy for more information. | |||

| 03 Nov 2022 | A listener asks: Could NOT having insurance be a better deal? | 00:26:43 | |

It’s open enrollment for 2023 health insurance for lots of folks — a time when you might find yourself asking: what good is health insurance anyway? One listener wrote to us about his son, a student with no income. Dad asks, If the son could get charity care (financial assistance) at his local hospital…. should he bother getting health insurance? The big picture question: If you’re broke, and can’t get insurance from work, what are your best options? The big picture answer: It totally depends!

We had expert help here: Karen Pollitz, a senior fellow at the Kaiser Family Foundation, and . Jared Walker, founder of Dollar For, and a super-expert on charity care. If you want to go deeper:

We’d love for you to support this show. Now is a great time to do it. This month, every dollar you donate is DOUBLED, thanks to NewsMatch and the Institute for Nonprofit News. Holy cow, what a deal.

Hosted on Acast. See acast.com/privacy for more information. | |||

| 17 Nov 2022 | Health insurance post-Roe, and a grassroots network of abortion funds | 00:26:06 | |

Since the Supreme Court overturned Roe v. Wade, abortion has been banned in more than a dozen states. As you choose your insurance plan for next year, you might be wondering: How does that affect my insurance plan? We learned two big things. First: There’s no one answer (and few answers are settled yet). A lot depends on where you live, and where you work. But second: For lots of people, for a long time, insurance has rarely been a help in accessing abortion. Most people pay cash. And lots of people can’t afford to. But there are organizations who have been tackling this issue for decades — abortion funds. We’re big fans of when regular people find a way to help each other survive this messed-up, profit-driven health care system — and abortion funds are a huge example of that kind of effort. There’s a lot we can learn from them. We talk with Oriaku Njoko, executive director of the National Network of Abortion Funds, and Tyler Barbarin, a board member with the New Orleans Abortion Fund, to learn from their experience. Here's a transcript of this episode. We’d love for you to support this show. Now is a great time to do it. This month, every dollar you donate is DOUBLED, thanks to NewsMatch and the Institute for Nonprofit News. Holy cow, what a deal. Here, go for it. Hosted on Acast. See acast.com/privacy for more information. | |||

| 01 Dec 2022 | The best video about health insurance, ever | 00:18:58 | |

A couple months ago, we started getting messages from listeners telling us: you gotta watch this video. It’s a thirty minute YouTube video from a creator named Brian David Gilbert, and it’s probably the best video about health insurance we’ve ever seen. Brian David Gilbert is best known for his highly-detailed, hilarious videos for Polygon, a media company about video games. But when he left that job to strike out on his own, he needed new health insurance. We talked with him about how that experience turned into one of the most difficult videos he’s ever made — and this is a guy whose old job had him tracing things like Zelda storylines across decades-long franchises. You can watch the full video here. Other delightful BDG creations discussed in this episode:

Special thanks to Wil Williams, Sarah Ballema, Josh Rubino, and Bea Bosco for adding their voices to this episode! AND: We’d love for you to support this show. Now is a great time to do it. This month, every dollar you donate is DOUBLED, thanks to NewsMatch and the Institute for Nonprofit News. Holy cow, what a deal. Here, go for it. Hosted on Acast. See acast.com/privacy for more information. | |||

| 19 Dec 2022 | Like pulling teeth. | 00:25:45 | |

When a car hit Susan and knocked out a bunch of teeth, her health insurance was supposed to pay for her oral surgery, and she knew it. So why has she had to chase them for 18 months and counting? Getting insurance to pay for anything dental is usually hard, but this had us asking ourselves… is it usually this hard? We connected Susan with law professor Jacqueline Fox — who, when she was practicing law, fought insurers on behalf of patients. And who says Susan has “done everything right.” We’ve started to wonder whether Susan’s troubles could be related to broader accusations against her insurer, Ambetter, the largest provider of plans on the Obamacare marketplace. Here’s a transcript of this episode. We’d love for you to support this show. Now is a great time to do it. This month, every dollar you donate is DOUBLED, thanks to NewsMatch and the Institute for Nonprofit News. Holy cow, what a deal. Here, go for it. Send your stories and questions or call 724 ARM-N-LEG. Hosted on Acast. See acast.com/privacy for more information. | |||

| 29 Dec 2022 | 2022 in Review | 00:13:42 | |

The Arm and a Leg editorial team gathered to talk about the moments from 2022 that we’ll never forget — including when work collided with real life. We’re so lucky we get to do this work, and we couldn’t do it without our community. From sending us your stories and questions, to supporting the show financially, our listeners and subscribers are what this show runs on. Thank you. If you want to help us take on 2023, now is a great time to contribute. This month, every dollar you donate is DOUBLED, thanks to NewsMatch and the Institute for Nonprofit News. Holy cow, what a deal. Here, go for it. Here’s a transcript of this episode. Send your stories and questions or call 724 ARM-N-LEG. Hosted on Acast. See acast.com/privacy for more information. | |||

| 19 Jan 2023 | Can They Freaking Do That?!? (2023 Edition) | 00:21:25 | |

We’re kicking off the year with a throwback. We revisit a 2019 episode that opened up new possibilities for fighting back against outrageous medical bills — a theme we’ll spend a lot more time exploring this year A listener named Miriam got a bill from a medical testing lab she’s never heard of, for $35. Then, a follow-up bill said if she didn’t pay up right away, that price was going up — WAY up: to $1,287. Which raises the kind of question that comes up a LOT with medical billing: Can some random lab hit you up for money — and then threaten you with a late fee of more than $1,000?? We went to find out. The answer: They can try. And a lot of the time, they’ll get away with it. But we found experts who explain how, sometimes, we can fight back— by threatening to take them to court. If you’ve got the time and the moxie, these experts say you’re on solid legal ground, and you really can make the other side accept a fair offer. We’ll come back to this idea next time. Meanwhile, here’s a 2020 episode with the story of a guy who took his local hospital to court, and won. The original version of this story, from 2019, found us learning about a couple topics we went on to explored in more depth later: Surprise bills — which we got new legal protections from in 2022— and the role of private equity in health care, both how it’s been expanding, and how some doctors are trying to fight back. Here's a transcript of this episode. Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 09 Feb 2023 | The bill looked like BS. So she took it to small claims court. | 00:25:36 | |

“I sued a hospital in small claims court and lost — here’s what I learned.” That was the subject line for an email we got from listener Lauren Slemenda. She wrote: “I feel like I won” — and we knew we needed to talk with her. She wants to encourage more people to try taking providers to court over unfair bills. “If everybody that they screw stands up,” she says, “They can't afford to pay a lawyer to defend against all of those [cases].” It’s an interesting idea for sure — What if more people use small claims court to fight messed-up medical bills? Like, a lot more people? — and we’ll be exploring it in the coming months. Meanwhile, Lauren’s story has lessons for all of us. For instance, even though she lost her case, she doesn’t expect to pay a cent. Here’s a transcript of the episode. More helpful resourcesWant to try some of Lauren’s tactics? Looking up billing codes: The latest First Aid Kit newsletter is all about fact-checking medical bills and includes a section about examining billing codes. We'll go deeper on those codes in the next installment. Dealing with debt collectors: We discussed knowing your rights when dealing with debt collectors with a couple of experts in this very-fun episode. Lauren got her dealing-with-debt-collectors playbook from journalist and friend-of-the-show Marshall Allen. His book, Never Pay the First Bill, includes a template of a letter you can send to a debt collector, challenging them to document their claim. Exploring small claims court: We first got tipped off to this aggressive approach in a story we re-played recently: Can They Freaking Do That?!? ... and followed up with the story of Jeffrey Fox, who successfully used small claims court to force a big hospital to refund a $2,000 charge. David vs. Goliath. Send your stories and questions. Or call 724 ARM-N-LEG. And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 02 Mar 2023 | Lessons from “wrestling with a giant” | 00:19:41 | |

The ER visit was quick and uneventful. The bill was $1,300. Our listener decided to push back. He didn't win, but he learned a lot — and so did we. We had help, from an expert we met by visiting a Renaissance Fair — which we did in this very fun early episode. Kaelyn Globig, head of advocacy for the Rescu Foundation, is a medical-bill wizard, and no one has taught us more. In this story, she teaches us how to find out what Medicare pays for a given procedure — here’s the guide she shared with us — and how to use that information. We also got advice on dealing with debt collectors — when it makes sense to file a dispute — from April Kuenhoff, an attorney with the National Consumer Law Center. She shared resources too. Here are sample letters — templates you can edit:

Here’s a transcript of the episode. Send your stories and questions. Or call 724 ARM-N-LEG. And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 23 Mar 2023 | A doctor’s love letter to ‘the People’s Hospital’ | 00:28:59 | |

What if we had a decent, publicly-funded health system — available to everybody, with or without insurance? We’ve got one, says Dr. Ricardo Nuila. It’s where he works. And it could be a model for the whole country. Yes, really. That’s the pitch he makes in his new book, The People’s Hospital: Hope and Peril in American Medicine. It’s a love letter to Houston’s Ben Taub hospital, and an argument for bringing Ben Taub’s model — efficient, innovative, and cheap —to the rest of the country. And if that seems unlikely in today’s political climate, well: Ben Taub’s wild origin story was plenty unlikely too. That story takes us to the 1960’s, when Dutch novelist and playwright Jan de Hartog moved to Houston. He fell in love with the bustling, futuristic home of NASA and the Astrodome. But he also discovered the city’s dreadful underside: a neglected charity hospital where largely African-American patients are left to seek health care in unsanitary and unsafe — hellish — conditions. De Hartog and a group of Quaker volunteers waged a campaign to change that, and eventually found an unlikely ally who brought it over the finish line. The People's Hospital is a heck of a book. We might want to start a book group someday, just to talk about it. If you want to grab a copy, here’s a link. (Or: Audiobook, or ebook.) Here’s a transcript of the episode. Send your stories and questions. Or call 724 ARM-N-LEG. And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 13 Apr 2023 | A $229,000 medical bill goes to court | 00:26:49 | |

Before her surgery, a hospital told Lisa French she would end up owing them $1,337. After insurance paid them — more than they’d expected — the hospital billed her $229,000. And sued her for it. Her case went all the way to the Colorado Supreme Court. The questions before the court, and how they ruled, have potentially major implications for our legal rights when it comes to fighting unfair medical bills — and how some hospitals might be thinking about their next move. Here’s a transcript of the episode. Send your stories and questions. Or call 724 ARM-N-LEG. And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 03 May 2023 | Mental health ‘ghost networks’ — and a ghost-buster | 00:24:41 | |

For lots of people, trying to access mental health treatment — like a therapist or a psychiatrist —is nothing short of a horror story. You could even call it a ghost story. A “Ghost network” is what researchers and journalists call it when your insurance plan offers a list of “in-network” providers that turns out to be bogus. Attorney Abigail Burman has studied this haunted phenomenon, and she’s become a part-time volunteer ghostbuster for people in her life. She’s here to share her tactics with us — including some key legal terms that can provide leverage. Abigail has written up a guide to her strategy, and she’s given us permission to share it. You’ll find it — lightly edited, and with some additional insights from our talk with her, over on First Aid Kit. Warning: No silver bullets here. It’s still really, really hard. But Abigail has definitely got some hard-won insights we can use. Here’s a transcript of this episode. Send your stories and questions. Or call 724 ARM-N-LEG. And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 25 May 2023 | A ‘payday loan’ from a health care behemoth | 00:22:51 | |

When a New York doctor tweeted recently about “payday loans” for doctors from a branch of UnitedHealth Group — which operates the giant insurance company UnitedHealthcare — we were intrigued. Especially when we saw that the loan product — a “cash flow solution” for health care providers — was real. The doctor’s tweet essentially accused UHG’s insurance arm of causing cash flow problems for providers in the first place, by denying claims and delaying payments — which echoes complaints we’ve heard over the years, and which the original tweet called “genius” — as in Evil Genius. When the boss who’s paying you late offers to front you money, at interest, to tide you over, it does sound like… a conflict of interest. It turns out, because UnitedHealth Group is such a big, complex enterprise, it’s not quite that simple. But UnitedHealth Group’s size and complexity turns out to be the story. The company has grown into a “behemoth,” running the country’s biggest insurance company, and becoming the biggest employer of doctors, while also running big parts of the business-side back end for big chunks of the health care ecosystem. As one expert told us, “There's very little good news about what happens when these organizations. or these sectors of health care get bigger.” Costs and prices tend to go up, without a bump in quality. And regulators, we learned, have struggled to keep up. It’s a wild ride with a sobering conclusion — and very much worth taking. As the expert who labeled United a behemoth wrote: “United has grown to its present immense scale largely without public knowledge.” Now we know. And knowledge is the beginning of power. BONUS TIP: This story reminded us of themes and insights from novelist, journalist, and activist Cory Doctorow, especially his recent book Chokepoint Capitalism and his recent essays about the “enshittification” of online life. We also like Cory’s novels a lot, and have learned a ton from them. They’re often called science fiction, but the tech is usually present-day, or about a month into the future. His latest, Red Team Blues, is a smart, fun techno-thriller. Here’s a transcript of this episode. Send your stories and questions. Or call 724 ARM-N-LEG. And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 15 Jun 2023 | Credit Card, Please | 00:21:49 | |

A listener’s doctor wanted her credit card info up front — before her appointment. She wondered: Do I need to give it to them? We did too. After all, who wants the risk of being overcharged — and then having to fight for money back? Experts gave us their best advice, including a couple of tricks to try, and a legal protection you may be able to rely on. Meanwhile, Elisabeth Rosenthal, senior contributing editor at KFF Health News, filled us in on the rapid growth of medical debt as a financial product, including specialized credit cards and financing plans pushed by hospitals and other providers. They can come with steep interest rates, and (surprise, surprise) the terms aren’t always spelled out clearly. The federal Consumer Financial Protection Bureau has been issuing reports, including a handy FAQ, but hasn’t taken enforcement action in a decade. Here’s a transcript of this episode. Send your stories and questions. Or call 724 ARM-N-LEG. And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 06 Jul 2023 | Wait, what’s a PBM (and how do they work)? | 00:21:31 | |

If you’ve been told your insurance won’t cover your meds — or that you’re gonna have to pay an arm and a leg for them — you’ve met a PBM: a pharmacy benefits manager. And: Experts say they play a big role in jacking up drug prices overall. But how, exactly? We took a deep dive. This episode first went out in 2019. We’re bringing it back because PBMs are in the news these days: Congress is targeting them, in an effort to to be seen doing something about prescription drug prices. And PBMs’ sometimes-rival, the powerful pharmaceutical industry lobby, is flooding the airwaves with ads attacking them. There’s been a little news since 2019: Although Congress is still catching up, all 50 states have passed some laws pertaining to how PBMs work. We’ve got an update on that. Here’s a transcript of this episode. Send your stories and questions. Or call 724 ARM-N-LEG. And of course we’d love for you to support this show. Correction: A previous version of this episode misidentified the parent company of Express Scripts. Hosted on Acast. See acast.com/privacy for more information. | |||

| 27 Jul 2023 | How to Get a Surprise Bill on Your Way to the Hospital | 00:19:44 | |

For a year and a half now, the No Surprises Act has protected patients from some of the most outrageous out-of-network medical bills. But Congress left something pretty crucial out of the law — bills from ground ambulances. We look at just how wild ambulance bills can be, with a story about three siblings who took identical ambulance rides — from the same car wreck to the same hospital — and got completely different bills. (Thanks to Bram Sable-Smith who reported the story for the Bill of the Month, a series from NPR and KFF Health News.). And we find out how ambulance bills ended up being so random — a story that takes us back to the 1970’s. Plus, what you can do if you get hit with an out-of-network ambulance bill:

Want to share your thoughts on how Congress should deal with out-of-network ambulance bills? A federal advisory committee wants to hear them. You can email them here. Here’s a transcript of this episode. Send your stories and questions. Or call 724 ARM-N-LEG. And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 17 Aug 2023 | Something's coming, something good. | 00:03:38 | |

Hey there— our next story is gonna take a little more time to cook, but it is going to be SO worth it. It involves John Green, author of The Fault in Our Stars — and yes, we've got an interview with him — and a global fight against multi-drug resistant tuberculosis. ... which turns out to be directly related to fights over the prices of drugs like insulin and humira in this country. Meanwhile, let me recommend a story from ProPublica that's related to a story we did here a few months ago. You might remember our recent episode about United HealthGroup, and how it's become a behemoth in recent years. That story started with a complaint from a doc in New York. ... who had a lot more tips than I could run down — or fit in one episode — and they weren't all just about United. ProPublica's Cezary Podkul took the time to verify a big one: About zillions of dollars in fees that docs are paying — dollars that ultimately come out of our pockets — just to get paid. Oh, and: If you aren't getting our First Aid Kit newsletter, this is a great time to sign up. We've started a series about how to fight with insurance that, unfortunately, a lot of us are gonna need at some point. We'll be back in a few weeks, with John Green, TB, and the fight over drug prices. Send your stories and questions. Or call 724 ARM-N-LEG. And of course we’d love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 07 Sep 2023 | John Green vs. Johnson & Johnson (part 1) | 00:22:48 | |

This episode is special. When we heard that widely-beloved writer John Green was rallying his online community around a fight over drug prices — and apparently making a difference — we were pumped. And this story took us in so many different directions: Literally around the world, and then straight back home. The drug in question is bedaquiline, made by Johnson & Johnson. It treats drug-resistant tuberculosis, and its price has been a huge obstacle to getting it to places it’s needed most — primarily places far away from the U.S. But the reason this TB drug costs so much overseas is also one of the main reasons that important drugs here are so expensive — drugs like insulin, Humira and… well, just about everything: Legalistic patent games that pharma companies have mastered. So, in addition to John Green — and yes, we talked with John Green — we also talked with one of the world’s leading experts on drug-patent games, Tahir Amin. Also, John Green is a great storyteller. So hearing him tell the story of how he became obsessed with tuberculosis is bittersweet. And in order to make sense of any of this, we had to dig into the story of how John Green and his brother Hank became (and remain) YouTube superstars. For more than 16 years, they’ve been building a community of “nerdfighters” — nerds fighting to make the world a better place. It’s a profoundly sweet and fun story, and everything we’re trying to do here owes them a debt. Oh, finally: This is, as you’re probably guessing by now, an epic story. It’s gonna take two full episodes of An Arm and a Leg to tell it all. So, we hope you enjoy part one. There’s more coming in a few weeks. Hosted on Acast. See acast.com/privacy for more information. | |||

| 28 Sep 2023 | John Green vs. Johnson & Johnson (part 2) | 00:26:29 | |

This is part two of our globe-spanning story about drugs, patents, and YouTube megastar John Green. Quick recap: In our last episode, we learned how writer and YouTube star John Green kicked up a fight with Johnson & Johnson over a medicine called bedaquiline. And appeared to score a victory. Here, we dig into the backstory: How everything John Green and his fans won was built on activism going back 20 years, and spanning multiple continents. All of it illustrates how pharma companies work the patent system to extend their legal monopolies on medicine way beyond the standard 20 years, and how that leads to high drug prices here and abroad. And what we can maybe do about it. This episode starts in 2004, when India began the process of changing its patent laws to align with global trade rules. Activists there managed to carve out exceptions to the law to prevent some of the worst patent abuses. Fast forward to this year, when those legal safeguards become key to unlocking new doors in the fight against TB. Meanwhile, the proponents of those Indian safeguards are here in the U.S., pushing for drug patent reform here. Which not only could help Americans, but also influence global standards. Here's a transcript of this episode. Send your stories and questions. Or call 724 ARM-N-LEG. And of course we'd love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 19 Oct 2023 | Paging Dr. Glaucomflecken: Presenting “The Nocturnists - Conversations: Will & Kristin Flanary (The Glaucomfleckens)” | 01:04:12 | |

First: an update on our recent two-parter with the writer John Green, about the global, decades-long fight to make an important tuberculosis drug more widely available. Just two days after we posted part 2, the activists waging that battle scored a major victory. John Green was kvelling on YouTube, of course. We’ll get you up to speed. And for the meat of this episode, we’ve got a guest a lot of you have been asking for: Physician/comedian Will Flanary, AKA Dr. Glaucomflecken. His punchy videos satirizing the absurdities and cruel complexities of the American health care system have been a fan favorite for years among An Arm and a Leg listeners (and us too). We’re sharing a delightful and moving conversation with Dr. G and his wife, educator Kristin Flanary (AKA @LadyGlaucomflecken online), from our pals at The Nocturnists, a podcast about the experiences of health care workers. As the Glaucomfleckens tell Nocturnists host Dr. Emily Silverman, the inspiration behind Flanary’s most biting videos. came from the couple’s experience dealing with health insurance after he suffered a near-fatal heart attack. Check out the Nocturnists here or wherever you get your podcasts, and Dr. Glaucomflecken’s videos on TikTok, Instagram, and YouTube. Send your stories and questions for An Arm and a Leg, or call 724 ARM-N-LEG. And of course we'd love for you to support this show. Hosted on Acast. See acast.com/privacy for more information. | |||

| 02 Nov 2023 | “Your Money or Your Life”: Dr. Luke Messac’s book on the history of medical debt | 00:25:48 | |

In 2019, Dr. Luke Messac was a medical resident who found himself spending his day off in a courthouse archive. He’d heard about hospitals suing their own patients over unpaid medical bills. He wanted to know if the hospitals he worked in were doing the same. They were. Trained as a historian, Messac then set out to trace the history of this phenomenon, and the story of medical debt in the U.S. His new book, Your Money or Your Life is the result of that research. Luke Messac sat down with us for a chat about how he got interested in medical debt, how medical debt became the massive problem it is today, and what he thinks people who work in health care can do to start to fix it. ALSO: Hey, it’s the BEST time to support this show with a donation. Thanks to NewsMatch, any gift you make, up to $1,000, will be doubled. It’s a great deal, and it will set us up to kick maximum butt in 2024. Here’s the link, go for it! Hosted on Acast. See acast.com/privacy for more information. | |||

| 16 Nov 2023 | To get health insurance, this couple made a movie | 00:18:42 | |

Last fall, actor-writers Ellen Haun and Dru Johnston were hustling to get their health insurance sorted out for 2023. To qualify for insurance through the actor’s union, SAG-AFTRA, Ellen would have to book a little more work — doable, but not a sure bet. So they came up with a plan: crowdfund a bunch of money to make a short film, starring Ellen … called “Ellen Needs Insurance,” of course. It worked! And the movie, a 13-minute comedy, is terrific. Ellen and Dru sat down with us to go over how they made the whole thing happen, and how this year’s Hollywood strikes changed their perspectives. Here’s a transcript of this episode. ALSO: Hey, it’s the BEST time to support this show with a donation. Thanks to NewsMatch, any gift you make, up to $1,000, will be doubled. It’s a great deal, and it will set us up to kick maximum butt in 2024. Here’s the link, go for it! Hosted on Acast. See acast.com/privacy for more information. | |||

| 07 Dec 2023 | When hospitals sue patients (part 1) | 00:28:07 | |

Hey, it’s the BEST time to support this show with a donation. Thanks to NewsMatch, any gift you make, up to $1,000, will be doubled. It’s a great deal, and it will set us up to kick maximum butt in 2024. Here’s the link, go for it! We’ve been working on this investigation all year, with our partners at Scripps News and the Baltimore Banner. For years, we’ve been hearing about hospitals suing patients over unpaid medical bills – sometimes even in bulk, by the hundreds or thousands at a time. Many of the patients getting sued are already facing financial hardship, or like one couple we interviewed, already in bankruptcy. Judgments against patients in these suits can be life changing. But according to experts, these lawsuits don’t recoup a ton of lost revenue for hospitals. So why do they happen? And what if hospitals stopped doing it completely? In this episode, we talk to a former sales rep for a medical-debt collections agency — who now steers hospitals away from efforts to collect money, via lawsuits or other means, from folks who just don’t have it. He tells hospitals: This is better for your bottom line. Stay tuned for part two, coming in two weeks. … and to preview some of what’s in it — plus a whole lot more excellent reporting — check out the Baltimore Banner’s story: Maryland hospitals stopped suing patients with unpaid bills. Will they start again? This series is produced in partnership with the McGraw Center for Business Journalism at the Craig Newmark Graduate School of Journalism at the City University of New York. … and supported by the Fund for Investigative Journalism. OOH: And don’t forget. It’s prime time to make a donation and support this show. Here’s a transcript of this episode. Hosted on Acast. See acast.com/privacy for more information. | |||

| 21 Dec 2023 | When hospitals sue patients (part 2) | 00:36:36 | |

Hey! The BEST time to support this show with a donation just got even better. Right now, any gift you make, up to $1,000, will be matched TWO for ONE, thanks to a few super-generous Arm and a Leg fans who’ve pooled their dough. . It’s a great deal, and it will set us up to kick maximum butt in 2024. Here’s the link, go for it! And… are you ready for our most-ambitious story yet? We’ve been working on this investigation all year, with our partners at Scripps News and the Baltimore Banner. With those partners, we’ve dug up some surprising (and possibly uplifting) news about lawsuits in three states – Maryland, New York and Wisconsin — and what that news might mean for the rest of the country. This is part two of a two-part series. In part one, we examined the phenomenon of hospitals suing patients in bulk – sometimes hundred or thousands at a time – over unpaid bills. We learned that in many cases, those patients are struggling financially, and that the lawsuits aren’t very lucrative for hospitals anyway. So why did they happen in the first place? As one former collections industry insider told us, those decisions are “philosophically based.” In this episode — before getting to those surprising/hopeful findings — we try to understand that “philosophy,” perhaps best described as: business-as-usual. We speak with a former hospital billing executive and a representative from the third-party collections industry. This series is produced in partnership with the McGraw Center for Business Journalism at the Craig Newmark Graduate School of Journalism at the City University of New York. … and supported by the Fund for Investigative Journalism. Hosted on Acast. See acast.com/privacy for more information. | |||

| 28 Dec 2023 | One last tip before 2024 | 00:04:13 | |

Real quick: Now's the best time to support this show! Thanks to a few super-star Arm and a Leg listener/donors, your donation is matched two for one right now. Here's the link to donate. Ok, now: We’ve got a mini-episode for you today, a four-minute coda to the epic story we brought you in December. It features a last tip for anyone who might want to ask a hospital about charity care — which, as we learned from these recent stories, is most of us. And it comes with my big thanks for being part of this show’s community this year. You’re our reason for being, and our best sources. You’re also our biggest source of financial support, so I will ask one more time to pitch in now if you can. Thank you so much! We'll catch you in 2024. Hosted on Acast. See acast.com/privacy for more information. | |||

| 18 Jan 2024 | Self defense 101: Keeping your cool while you fight | 00:24:57 | |